ISC founded

1959

Griffon is founded as Waldorf Controls Corporation but assumes the name Instrument Systems Corporation (ISC) the same year.

ISC buys Telephonics

1961

ISC acquires Telephonics Corporation, a manufacturer of electronic devices for industry and defense founded in 1933. Telephonics would form the nucleus of ISC’s Electronics Group.

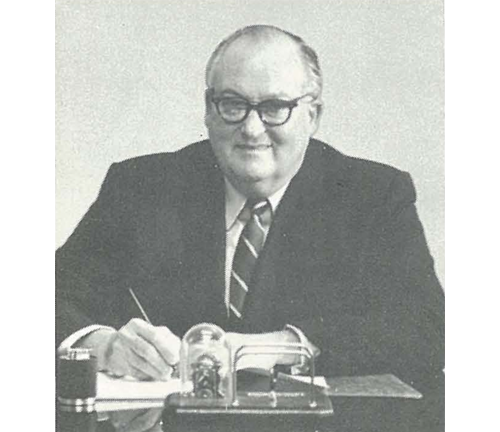

Garrett joins ISC

1964

Edward J. Garrett joins ISC as Chairman of the Board and President. Garrett closes underperforming plants and starts to seek civilian markets, while continuing to successfully procure government research and development contracts.

IPO on American Stock Exchange

1968

Fortune 500 Company

1970

ISC is listed for the first time on the Fortune 500 list at #489.

Fortune 500 Company

1971

ISC is listed for the second time on the Fortune 500 list at #473.

Blau succeeds Garrett

1983

Edward Garrett passes away and is succeeded by son-in-law Harvey Blau as Chairman of the Board and CEO. Blau joined ISC as director and secretary in 1966.

ISC acquires Oneita Knitting Mills

1984

ISC enters the textiles sector by acquiring Oneita Knitting Mills Inc. for $15 million.

ISC buys Clopay

1986

To drive its diversification strategy, ISC buys the Cincinnati-based plastics and garage door manufacturer Clopay Corporation for $40 million.

Company stock moves from American Stock Exchange to NYSE

1994

ISC becomes Griffon

1995

Seeking a name that more appropriately captures the diversified holding company’s motto of “strength through diversity,” Harvey Blau renames the company Griffon Corporation after the mythical creature that is part lion, part eagle.

Finotech Joint Venture

1996

Clopay forms Finotech, a joint venture with German-based Corovin GmbH, to manufacture specialty plastic film and laminate products in Aschersleben, Germany.

Kramer succeeds Blau as CEO

2008

Harvey Blau retires as CEO after 25 years but remains non-executive Chairman. He is succeeded as CEO by his son-in-law Ronald Kramer, a former investment banker and executive at Wynn Resorts, who has served on Griffon’s board of directors since 1993.

Transition

2008

Griffon begins building for the future. The company secures a new $100 million line of credit and engages with Goldman Sachs to lead a $250 million recapitalization to position the company for future acquisitions. Kramer divests Clopay’s underperforming installation services business.

Positioning for the Future

2010

Griffon relocates its corporate headquarters from Jericho, NY, to New York City.

Ames True Temper Acquisition

2010

Griffon acquires Ames True Temper, the leading U.S., Canadian and Australian provider of non-powered landscaping products, for $542 million in 2010.

Southern Patio Acquisition

2011

Griffon acquires the Southern Patio pots and plants division of Southern Sales & Marketing Group and integrates it into Ames True Temper.

Australia Expansion

2014

Griffon acquires Northcote Pottery and the Cyclone tools division of Illinois Tool Works, both based in Australia.

Ames is Renamed

2014

Ames True Temper is renamed The AMES Companies to better reflect the heritage of the business while recognizing the breadth of products in the portfolio.

20th Anniversary of Griffon

2015

On the 20th anniversary of the renaming of the company, Griffon Corporation refines its branding and corporate logo to better reflect its improved operational performance and future growth opportunities.

Griffon Acquires Hills Home Living

2016

Griffon acquires Hills Home Living, one of the most iconic and trusted brands in Australia and New Zealand, from Hills Limited. Hills is integrated into AMES Australasia.

Griffon recognized in the Fortune 1000 at number 967.

Griffon Acquires La Hacienda

2017

Griffon acquires La Hacienda, a UK-based outdoor living brand of unique heading and garden decor products. This acquisition establishes AMES with its first business located within the United Kingdom.

Griffon Acquires ClosetMaid

2017

Griffon acquires ClosetMaid, a leading manufacturer and marketer of closet organization, home storage, and garage storage products.

Griffon Acquires Harper Brush Works

2017

Griffon acquires Harper Brush Works, a leading U.S. manufacturer of cleaning products for professional, home, and industrial use with a legacy dating back to 1900. Harper expands The AMES Companies product offerings of brooms, brushes, and other cleaning products.

Griffon Acquires Tuscan Path

2017

Griffon acquires Tuscan Path, a leading Australian provider of pots, planters, pavers, decorative stone, and garden decor products.

Griffon Refocuses Portfolio with Plastics Sale

2018

Griffon sells its Clopay Plastic Products segment to Berry Global (NYSE:BERY) for $475 million. This divestiture better focuses Griffon’s portfolio on core markets, provides liquidity, and improves the company’s free cash flow conversion.

Griffon Expands UK Operations with Kelkay Acquisition

2018

Griffon acquires Kelkay, a UK-based manufacturer and distributor of decorative outdoor landscaping products. Kelkay, in concert with La Hacienda, provides AMES with a leading platform for growth in the UK market to garden centers, retailers, and grocers.

Griffon Acquires CornellCookson

2018

Griffon acquires CornellCookson to expand the Clopay Corporation commercial door portfolio. CornellCookson, founded in 1828, is a leading U.S. manufacturer and marketer of rolling steel door and grille products designed for commercial, industrial, institutional, and retail use.

Griffon Acquires Apta

2019

Griffon acquires Vatre Group (Apta), a leading UK supplier of innovative garden pottery, to enhance the AMES lawn and garden offerings in the UK and Ireland.

Griffon’s annual net sales surpass $2 billion for the first time.

2019

Griffon’s annual net sales surpass $2 billion for the first time.

Griffon divests System Engineering Group (SEG) to QuantiTech LLC

2020

The sale of SEG provides immediate value to Griffon’s shareholders by allowing Telephonics to focus more of its resources on growing its core defense electronics and systems product lines.

AMES Companies Acquires Quatro Design Pty Ltd (Quatro)

2020

Quatro is a leading Australian manufacturer of glass fiber reinforced concrete landscaping products for residential, commercial, and public sector projects.

Griffon Acquires Hunter Fan Company

2022

In its largest acquisition ever, Griffon purchases Hunter Fan for $845 million. Hunter, the #1 brand of residential ceiling fans in the US, represents Griffon’s push into indoor home décor.

Griffon divests Telephonics Corporation

2022

The sale of Telephonics to TTM Technologies strengthens Griffon’s balance sheet and focuses resources on core businesses. A part of Griffon since 1961, Telephonics leaves a legacy of innovation, and world-class engineering and manufacturing in support of US national and global security.